Analyze Sales Channel Profits effectively when importing settlements from e-commerce platforms like Amazon, eBay, or other sales channels. Accurately determining your profits is essential for understanding your business performance and making informed financial decisions.

PlugBooks simplifies this process by automatically generating a detailed Income Statement for each settlement, giving you a clear breakdown of revenue, expenses, and overall profit.

In this blog, we’ll guide you through how to analyze your settlements, interpret key financial data, and ensure you have a complete understanding of your profit margins across all platforms.

Step 1: Log in to Plugbooks

Log in to your Plugbooks account using your credentials. Once logged in, you’ll have access to your dashboard and all essential features, including settlement analysis.

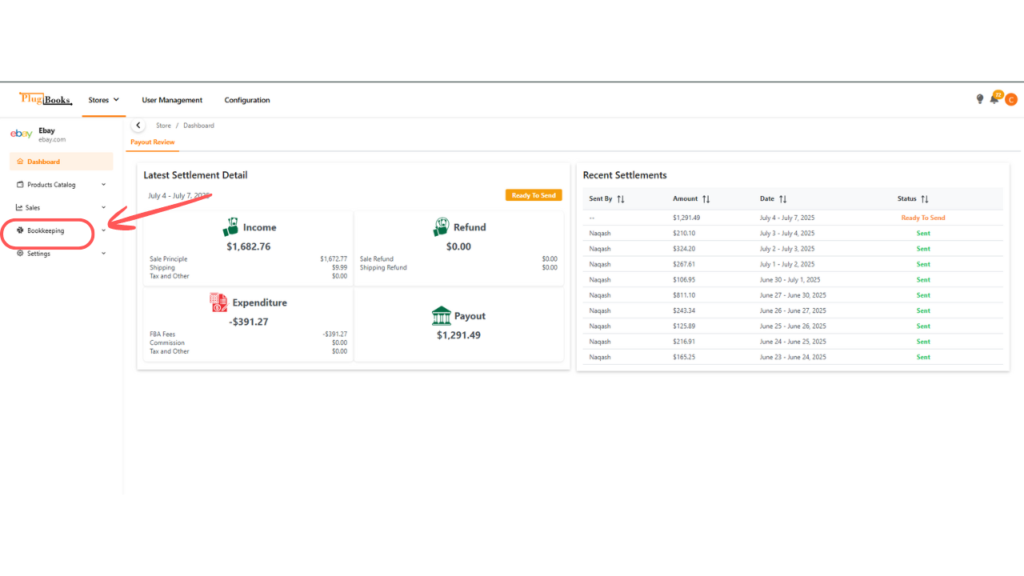

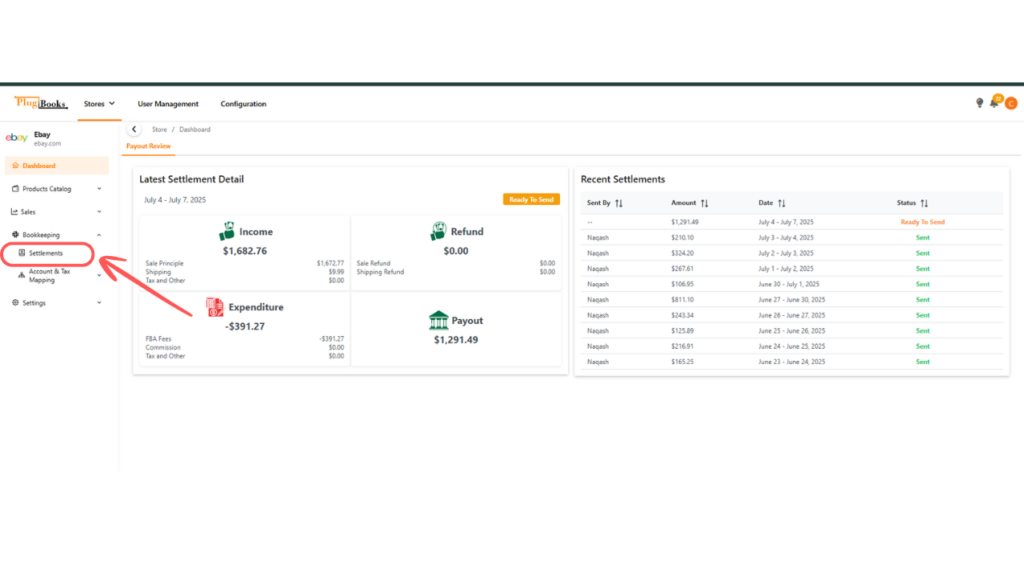

Step 2: Navigate to Settlements via Bookkeeping

- In the sidebar menu, click on Bookkeeping.

- Then, click on Settlements.

- You will be taken to a table displaying all settlements imported from your sales channels, such as Amazon or eBay.

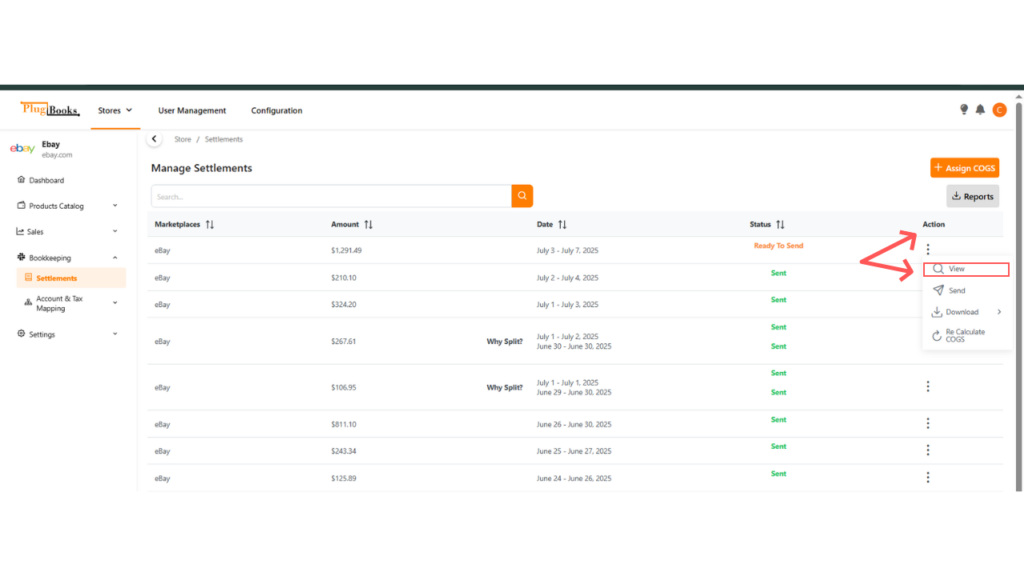

Step 3: Manage Settlement

- After clicking on Settlements, the Manage Settlements table will appear.

- Locate the settlement you want to view.

- Click the three-dot action button next to the settlement.

- Select View to see detailed information.

Step 4: Analyze Your Sales Channel Profits

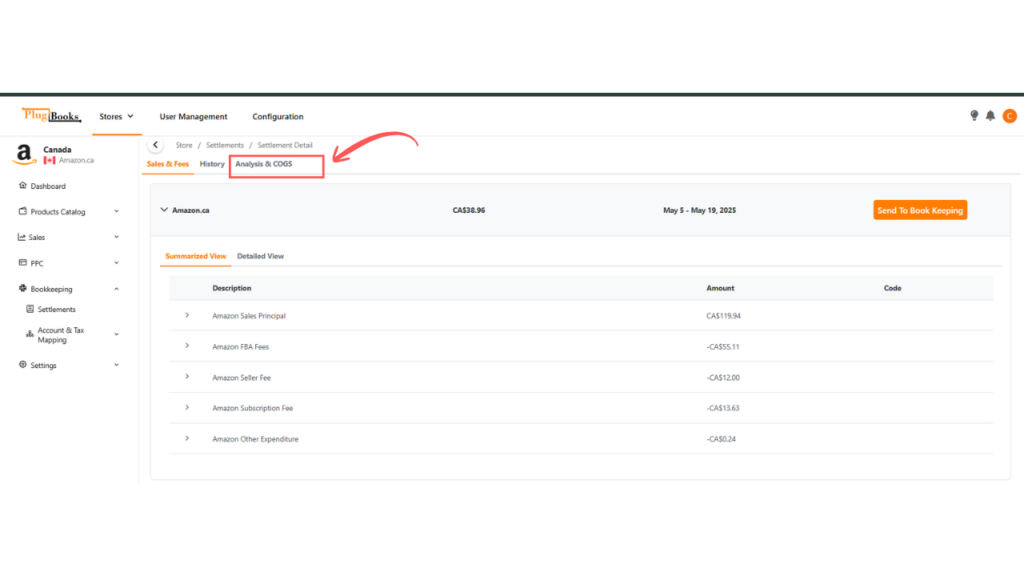

On the Settlement’s Detailed Page, navigate to the Analysis & COGS tab.

This section provides an in-depth breakdown of your settlement data, including key insights into cost of goods sold (COGS), revenue distribution, and overall profit margins.

Here, you can review and compare performance metrics for each sales channel, helping you understand exactly where your business is earning and spending the most.

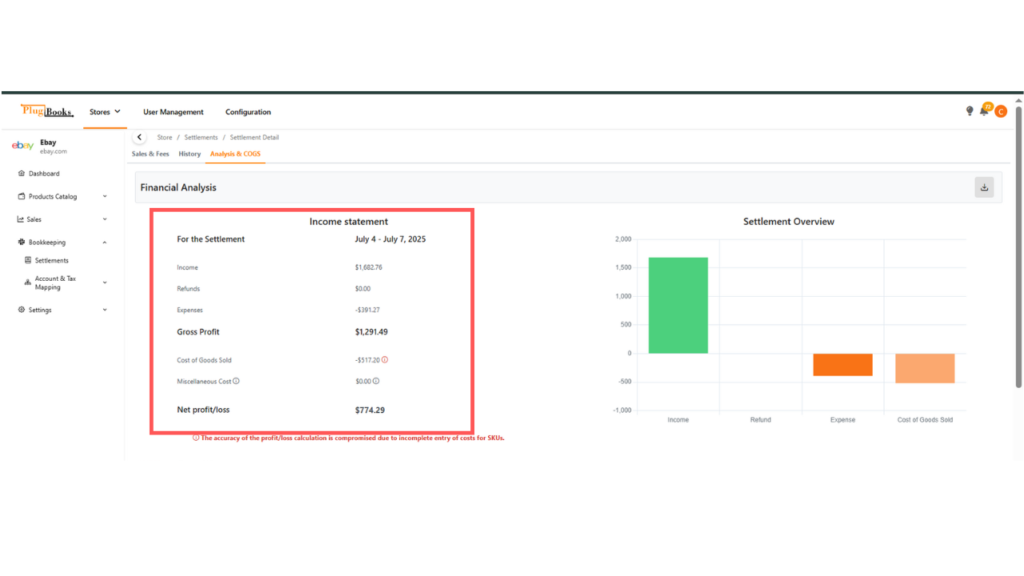

- Here, you will see the Income Statement, which breaks down your revenue, cost of goods sold (COGS), and the profit from the settlement.

This gives you a clear understanding of how much profit you’ve made from your e-commerce sales channel.

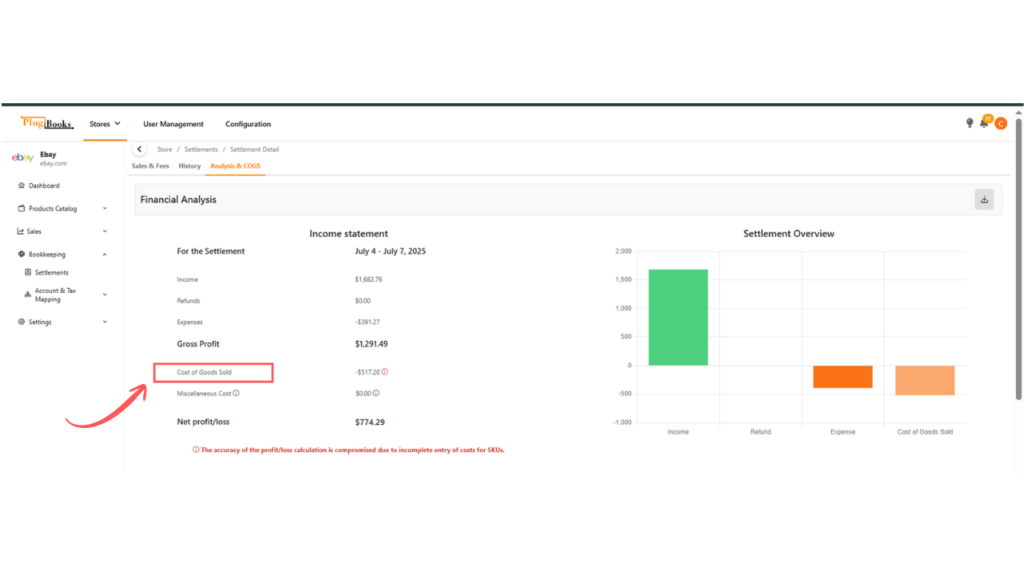

Step 5: Ensure Cost of Goods Sold (COGS) is Assigned

If the COGS is displayed as zero or shows an “i” icon in red, this indicates no cost has been assigned, which can lead to inaccurate profit calculations. Make sure to update the COGS for all products in the settlement.

For a detailed guide on how to assign COGS, read our guide on assigning Cost of Goods Sold.

Step 6: Add Indirect Expenses (Optional)

You can also enhance your financial analysis by including Indirect Expenses, such as shipping costs, platform fees, packaging charges, or other additional costs from your sales channels. Accounting for these expenses gives you a more accurate understanding of your true profit margins.

PlugBooks makes this process simple — you can easily input and categorize these expenses under the Miscellaneous Costs section in the Income Statement. This helps ensure that every cost related to your operations is tracked, improving the accuracy of your reports and helping you make smarter financial decisions.

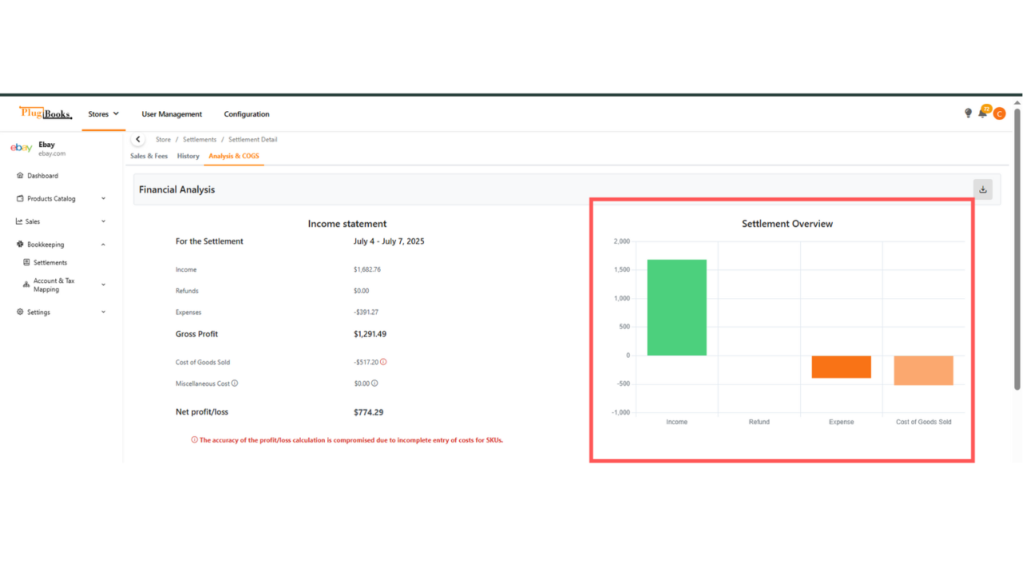

Step 7: Use Charts To Analyze Sales Channel Profits

PlugBooks also provides interactive charts that visually represent your settlement data in real time. These charts showcase your revenue, expenses, and profits, giving you a clear snapshot of your financial performance across all connected e-commerce platforms.

You can quickly analyze trends, identify your best-performing channels, and track overall growth with ease.

Helpful Resources:

- How to Assign Cost of Goods Sold (COGS) to a Settlement

- How to Enter Miscellaneous Costs for Accurate Settlement Analysis

Conclusion:

Plugbooks simplifies the process of analyzing profits from your e-commerce sales channels. By reviewing the Income Statement and ensuring COGS and indirect expenses are accounted for, you can track the profitability of each settlement with ease.

With built-in charts and easy-to-update fields, Plugbooks provides all the tools you need to maintain an accurate picture of your business’s financial health.