Bookkeeping services are essential for every small business, but managing finances manually can be stressful and error-prone. With PlugBooks, financial tracking becomes simple, automated, and accurate. Whether you are curious about managing costs, setting pricing for your services, or understanding overall bookkeeping, PlugBooks gives you the tools to run your finances efficiently.

Key Notes

- Fully automated bookkeeping

- Sync with banks, Amazon, eBay, and Shopify

- Real-time financial dashboards

- Tax-ready reports in one click

- Affordable for small businesses

What Are Bookkeeping Services?

If you’ve ever asked about financial management services, it’s the organized recording and tracking of all financial transactions, including income, expenses, invoices, payouts, and marketplace fees.

PlugBooks automates this process, ensuring accuracy, speed, and clarity. You also get a clear picture of what is included in bookkeeping assistance, such as transaction tracking, categorization, reconciliation, reporting, and tax summaries. Learn how to update bank account mapping in QuickBooks here.

Online Bookkeeping for Modern Businesses

Online bookkeeping eliminates spreadsheets and paperwork. Cloud-based tools like PlugBooks allow you to manage books, generate reports, and prepare for taxes digitally.

For bookkeepers, this also helps calculate how much to charge for bookkeeping services, since automation reduces manual workload and saves time.

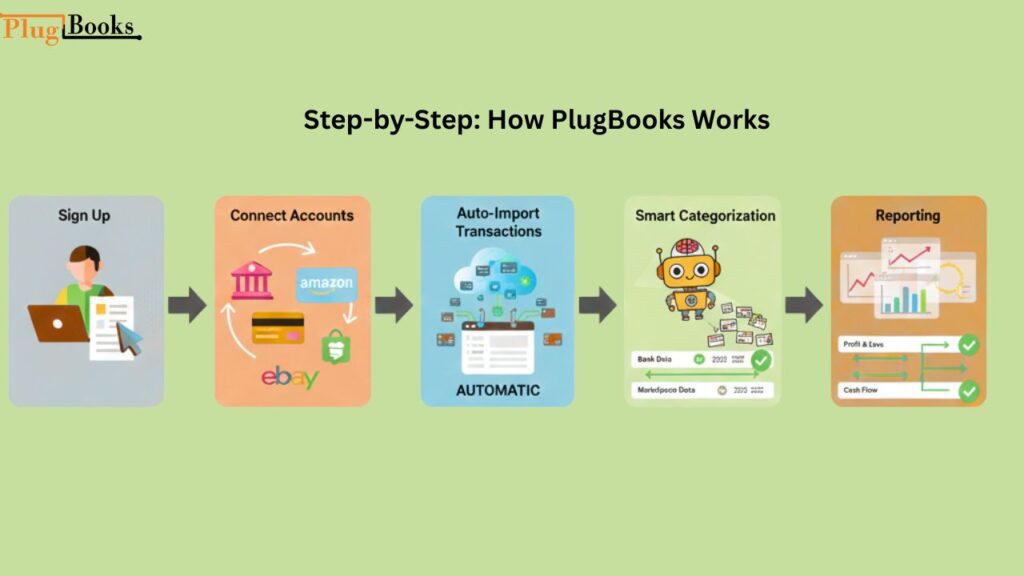

Step-by-Step: How PlugBooks Works

1. Sign Up

Create your PlugBooks account quickly and access the dashboard instantly.

2. Connect Your Accounts

Sync bank accounts, credit cards, Amazon, eBay, and Shopify.

3. Auto-Import Transactions

PlugBooks fetches all financial transactions automatically.

4. Smart Categorization

AI categorizes your income and expenses for accurate bookkeeping.

5. Reconciliation

Transactions are automatically matched with your bank and marketplace data. Learn how to update the chart of account mapping in PlugBooks to ensure everything aligns perfectly.

6. Reporting

Generate Profit & Loss, Balance Sheet, Cash Flow, and tax-ready reports in one click. You can also send backdated settlements or generate detailed order reports to keep your books up to date.

This process clearly shows what Record-keeping services are when using automated software.

Common Issues PlugBooks Solves

- Missing or duplicate transactions

- Wrong expense categorization

- Marketplace payout confusion

- Spreadsheet errors

- Tax preparation stress

PlugBooks reduces these risks and clarifies how much bookkeeping services cost in terms of errors or wasted time.

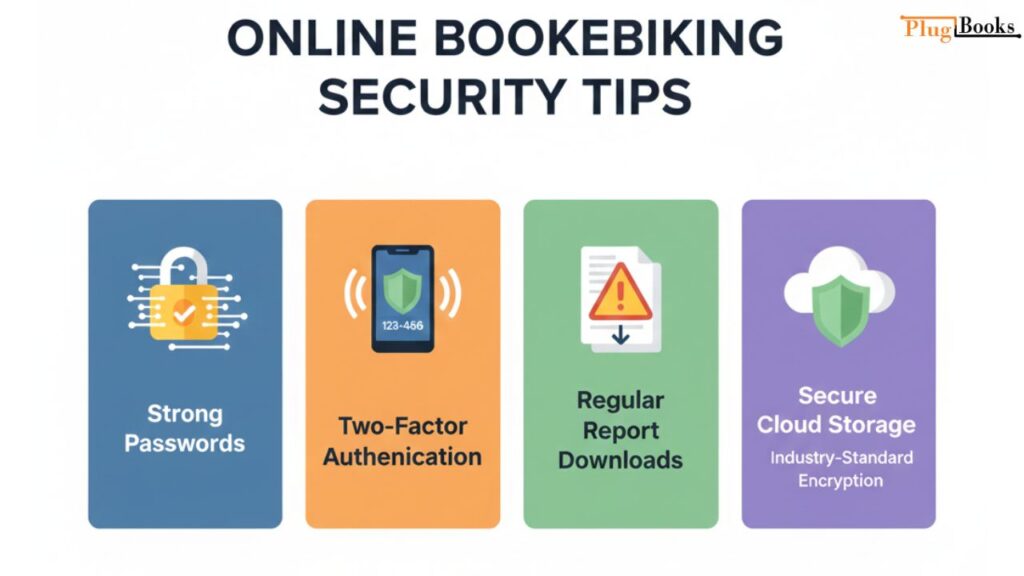

Security Tips for Online Bookkeeping

- Use strong passwords

- Enable two-factor authentication

- Avoid public Wi-Fi when accessing accounts

- Regularly download reports

PlugBooks provides industry-standard encryption and secure cloud storage.

Methodology

1. Data Import

PlugBooks automatically syncs bank accounts and connected marketplaces like Amazon, eBay, and Shopify.

2. Smart Categorization

Transactions are categorized based on rules and patterns to ensure accurate bookkeeping.

3. Reconciliation

Imported transactions are matched with bank and marketplace data to help identify discrepancies and ensure accuracy.

4. Real-Time Reporting

Generate Profit & Loss, Cash Flow, and tax-ready reports instantly for your business.

5. Tax-Ready Formatting

Financial data is structured to simplify tax reporting and filing.

6. User Dashboard

Approve, adjust, download, or share reports easily through PlugBooks’ intuitive interface.

By automating these processes, PlugBooks reduces manual effort, helping small business owners and bookkeepers manage finances efficiently.

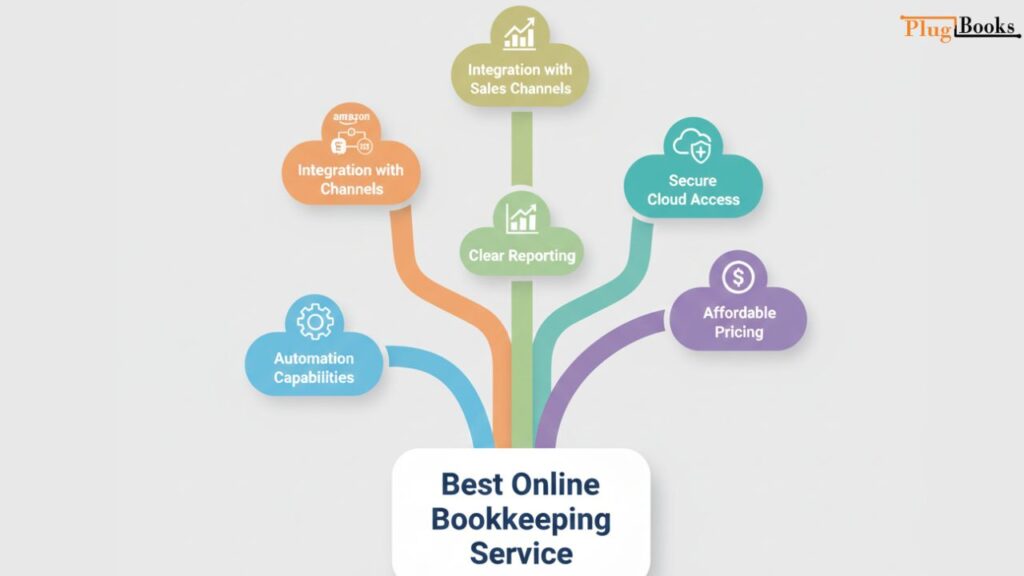

Which Online Bookkeeping Service Is Best for Your Business?

The ideal service is:

- Automated

- Affordable

- Easy to use

- Marketplace-friendly

- Tax-ready

PlugBooks meets all these requirements, making it the top choice. It explains what is included in bookkeeping services clearly, so business owners know exactly what they’re paying for.

How Much Does an Online Bookkeeping Service Cost?

One common question is how much small businesses typically pay for bookkeeping. Most online services range from $25–$200 per month depending on features. PlugBooks offers competitive and affordable pricing.

If you are a professional, PlugBooks also helps you estimate service fees, since automation reduces manual labor and saves time.

Do Small Businesses Need Bookkeeping Services?

Yes. Proper bookkeeping is critical for:

- Tracking cash flow

- Staying tax-ready

- Avoiding errors

- Making informed decisions

PlugBooks covers everything in a single dashboard and shows clearly what is included in bookkeeping services.

How To Choose the Best Online Bookkeeping Service

Checklist:

- Automation capabilities

- Integration with your sales channels

- Clear reporting

- Affordable pricing

- Secure cloud access

This helps answer how much is bookkeeping services worth to your business — PlugBooks offers high value with minimal cost.

PlugBooks: The Best Bookkeeping Software for Small Businesses

Perfect for:

- Amazon & eBay sellers

- Shopify store owners

- Freelancers and service providers

- Local small businesses

With PlugBooks, you get a clear view of all features included in your financial management and can confidently set your fees if offering bookkeeping professionally.

Real-Life Experience: How PlugBooks Revolutionized My Small Business

“Running a small eCommerce store in Texas, I used to spend hours every week drowning in spreadsheets and missed transactions from Amazon and Shopify. Since switching to PlugBooks, my financial management is fully automated, reports are instantly accurate, and I finally have complete visibility over my business.

It even helped me set fair pricing for my services and eliminated the stress of tax season. For any small business owner in the U.S., PlugBooks hasn’t just simplified bookkeeping — it’s transformed how I run my business.”

FAQs

1. What is online bookkeeping?

Online bookkeeping uses cloud software to manage financial records digitally, replacing spreadsheets and manual tracking.

2. How much does an online bookkeeping service cost?

Most services range from $25–$200/month. PlugBooks offers affordable plans for small businesses.

3. Do small businesses need bookkeeping?

Yes — to maintain accuracy, stay tax-ready, and make informed financial decisions.

4. What is included in bookkeeping?

Features include transaction tracking, reconciliation, categorization, financial reports, and tax summaries.

5. How much to charge for bookkeeping?

Depends on business size, complexity, and level of automation. PlugBooks reduces manual effort, helping bookkeepers set fair rates.

Quick Recap

- PlugBooks takes care of small business finances automatically.

- Learn the basics of bookkeeping

- Look into all the features that come with financial tracking.

- Learn about the usual costs of bookkeeping

- If you want to do bookkeeping professionally, set fair prices.

Conclusion

Bookkeeping doesn’t need to be stressful. With PlugBooks, small businesses and eCommerce sellers gain full control over their finances, automation, and reporting. From understanding what is bookkeeping services to knowing how much is bookkeeping services, PlugBooks makes 2025 simple and organized.