Difference Between Bookkeeper and CPA for Small Business USA is a question many owners face when running a business in the USA. Running a small business means wearing many hats — sales, operations, marketing, and finances. One of the biggest pain points is deciding who should manage your finances.

Many ask: Should I hire a bookkeeper, a CPA, or both? Understanding this difference can save you money, reduce stress, and prevent costly tax mistakes in 2026.

Key Difference Between Bookkeeper and CPA for Small Business USA

Why Small Business Owners Get Confused

Small business owners don’t have problems because they don’t pay attention to money; they have problems because they don’t know who does what. Hiring a CPA too soon could cost you a lot of money. If you only keep track of your books for too long, on the other hand, you can have trouble following the rules.

Here are some common problems:

- There are unclear duties between bookkeeping and accounting.

- Professional fees are going up.

- Worrying about getting in trouble with the IRS

- Not being able to see your money in real time

This tutorial helps you figure things out one step at a time.

What does a bookkeeper do? What is their job?

A bookkeeper keeps track of your money every day. Their job is to make sure everything is running smoothly and that everything is right and the same.

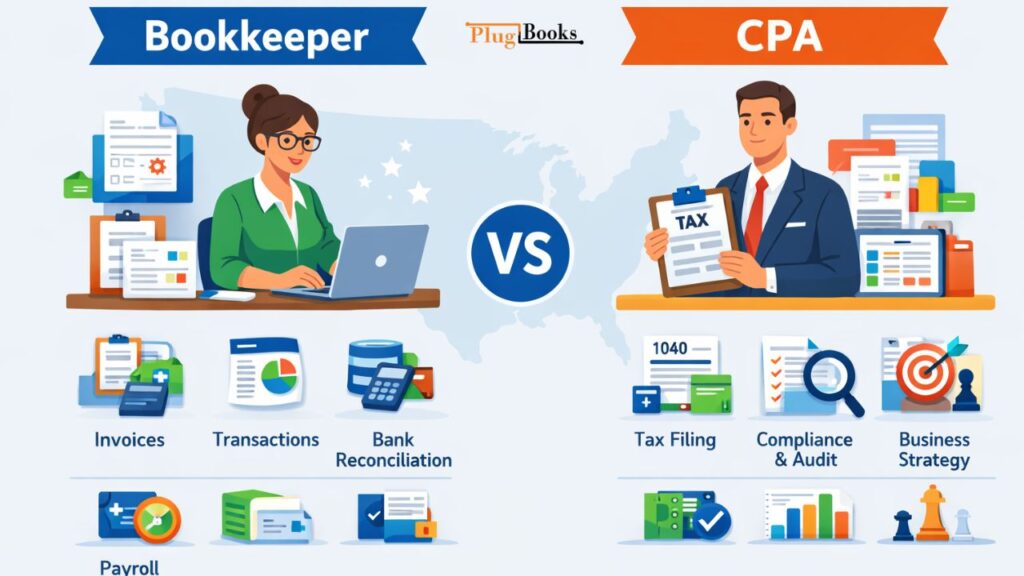

Key Responsibilities of a Bookkeeper:

- Taking care of bills and invoices

- Grouping transactions

- Reconciling bank accounts

- Help with paying employees

- Getting the books ready for an audit

A lot of business owners search for “business bookkeeping near me,” but in 2026, virtual bookkeeping is generally faster, cheaper, and more accurate. A bookkeeper keeps your records in order and handles your money every day.

What Is a CPA in Business?

So, what does a CPA do for a living? A CPA, or Certified Public Accountant, is a trained professional who helps people with their taxes, following the law, and making good money choices.

What a CPA Usually Does

- Planning and filing company taxes

- Financial statements

- Help on how to structure a business

- Study of growth and profit

A CPA protects your business from tax penalties and missed deductions, which gives owners peace of mind and transparent finances.

Bookkeeping vs CPA – Key Differences Explained

Understanding bookkeeping vs CPA helps you make smarter hiring decisions.

| Area | Bookkeeper | CPA |

| Daily transactions | Yes | No |

| Tax filing | No | Yes |

| Cost | Lower | Higher |

| Licensing | Not required | Required |

| Compliance advice | Limited | Advanced |

Bookkeeping keeps your business organized.

A CPA ensures your business stays compliant.

Bookkeeping vs accounting for small businesses

A lot of owners don’t know what these roles are:

- Bookkeeping: Keeping track of money issues

- Accounting: Looking at money matters

- CPA: An accountant who has a license and is backed by the law

Understanding this difference can assist you not spend too much or too little to help your business.

Bookkeeper vs. CPA: Which Is Best for Your Startup?

New firms need to make budgets.

Most of the time, new businesses need:

- Keeping track of costs

- Clear flow of cash

- Well-organized records

At this point, a bookkeeper is usually all you need.

When you need a CPA:

- Your first tax return

- Changes to how businesses register

- Getting ready for money or loans

Hiring depending on stage saves money.

Bookkeeper vs. CPA – Business Milestones Explained

You shouldn’t make decisions based on what you think. You should make them based on business milestones.

- Before you make money, hire a bookkeeper.

- Steady income: Bookkeeper and CPA for taxes

- Scaling: CPA for planning and following the rules

This way of working saves money and stress.

Virtual Help: CPA vs. Bookkeeper in 2026

A lot of businesses want virtual financial help in 2026.

Advantages of Virtual Bookkeeping

- Less expensive

- Access in real time

Advantages of a Virtual CPA

- Expertise across the country

- Faster communication

- Advanced tax planning

When it comes to business bookkeeping near me, virtual services often do better than traditional ones.

Outsource Bookkeeping for Small Business – Is It Worth It?

Many owners choose to outsource bookkeeping for small business to:

- Save time

- Don’t pay for hiring fees

- Make things more accurate

Outsourcing frees you up to work on growth instead of spreadsheets.

Bookkeeping Tips for Small Businesses in the USA

These suggestions for small business bookkeeping will help you keep your finances in order:

- Keep your personal and business money separate.

- Make sure your accounts are correct every month.

- Keep a close eye on your spending

- Automate when you can

- Look over reports often

Little things stop large problems from happening.

Bookkeeper vs. Accountant vs. CPA: How Are They Different?

To put it simply:

- Bookkeeper: Keeps track of transactions

- Accountant: Reads and explains data

They all have jobs, just not at the same time.

Which is better for your business: a bookkeeper or a CPA?

Ask yourself:

- Do I need daily financial organization? → Bookkeeper

- Do I need tax planning or compliance? → CPA

- Am I growing or scaling? → Both

The right decision depends on where your business is today.

How PlugBooks Makes Bookkeeping Easier for Small Businesses in the US

PlugBooks makes it easy for small company owners to keep track of their income, expenses, and bills all in one place, without having to worry about accounting. It automatically syncs data with QuickBooks and Xero, which cuts down on the need for manual work and mistakes that cost money.

Bookkeepers and CPAs can both operate more quickly and easily when their records are clean and well-organized. In 2026, this clarity will save time, make things more accurate, and offer owners more control over their money.

Questions That People Ask Often

1. What’s the difference between bookkeeper and CPA for small business USA?

A bookkeeper keeps track of daily records, while a CPA takes care of taxes, compliance, and strategy.

2. Do small firms in the US need a CPA?

No, although it is highly advised that you hire a CPA to help you file your taxes and stay in compliance.

3. Can a bookkeeper do the same job as a CPA?

No. It is against the law for a bookkeeper to file your taxes or speak for you in front of the IRS.

4. When is it a good idea to hire someone else to do my small business’s bookkeeping?

When keeping track of your finances takes too long or causes mistakes.

5. Is virtual bookkeeping safe in 2026?

Yes, it’s safe, correct, and used a lot in the US.

6. What is the price difference between a CPA and a bookkeeper?

Most of the time, bookkeepers are cheap each month, however CPAs charge more for specialist services.

A Quick Review

- Bookkeepers take track of daily money matters.

- CPAs take care of taxes and follow the rules.

- Outsourcing saves time and money.

- Virtual services will be the most popular in 2026.

- Pick based on the stage of your business

Last Thoughts

Understanding the Difference Between Bookkeeper and CPA for Small Business USA helps you avoid financial mistakes, reduce costs, and grow confidently. Choose the right support at the right time — and your business will be prepared, compliant, and financially clear in 2026.