What is a Marketplace Facilitator?

If you’ve ever sold products on platforms like Amazon, eBay, or Etsy, you’ve likely encountered the term Marketplace Facilitator. But what does it mean, and why does it matter to your business? Let’s break it down.

A Marketplace Facilitator is an online platform that connects sellers with buyers, enabling transactions. These platforms take on a crucial role by managing the process from listing to payment and, in many cases, even handling tax collection.

In the evolving landscape of e-commerce, understanding the responsibilities of a Marketplace Facilitator is essential—especially as laws around sales tax compliance become stricter.

Why Marketplace Facilitators Matter

Marketplace Facilitators have become indispensable in modern commerce. Here’s why:

- Simplified Operations: They streamline the buying and selling process, allowing sellers to focus on growing their businesses.

- Sales Tax Compliance: Most U.S. states now require Marketplace Facilitators to collect and remit sales tax on behalf of their sellers. This alleviates the burden of tax compliance for small businesses.

- Buyer Confidence: Trusted platforms often handle disputes, refunds, and customer support, creating a secure shopping experience.

Marketplace Facilitator Tax Explained

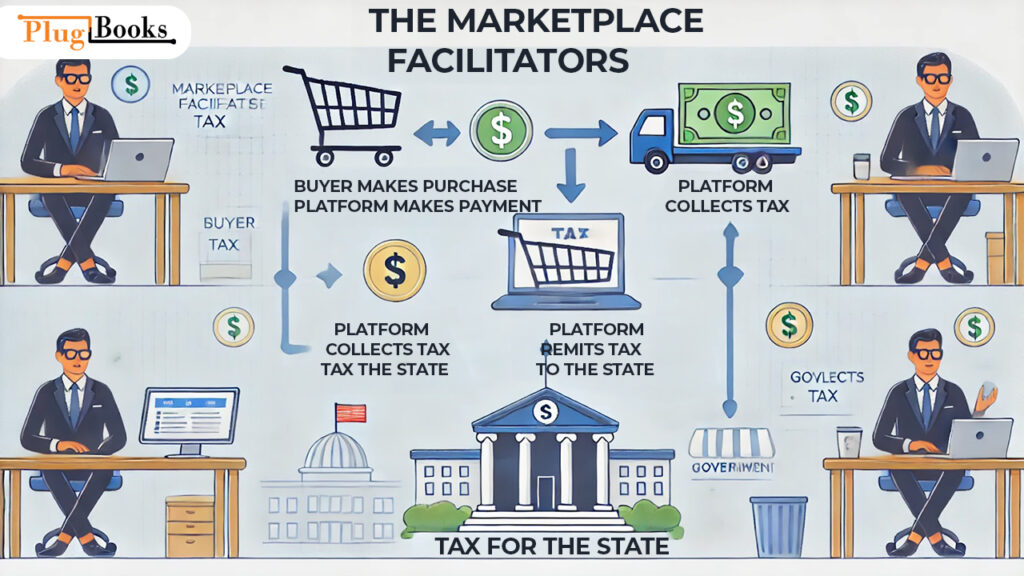

The Marketplace Facilitator Tax is a legal requirement for platforms to collect and remit sales tax on behalf of sellers. This legislation, introduced by various U.S. states, aims to simplify tax compliance in the rapidly growing e-commerce sector.

Here’s how it works:

- When a sale occurs, the platform calculates and adds the appropriate sales tax.

- The platform collects the tax from the buyer.

- The platform remits the tax directly to the state, fulfilling the seller’s obligation.

For example, if you sell a handmade item on Etsy to a customer in California, Etsy calculates the California sales tax, collects it during checkout, and sends it to the California tax authorities.

Benefits and Challenges for Sellers

Benefits

- Time Savings: You no longer need to track and remit sales tax for each state.

- Reduced Risk: Compliance is handled by the platform, reducing your exposure to audits and penalties.

- Focus on Growth: With tax duties off your plate, you can prioritize scaling your business.

Challenges

- Lack of Visibility: Some sellers find it harder to track tax transactions when platforms handle them.

- Higher Fees: Marketplace Facilitators may increase their fees to cover tax-related expenses.

Are You Impacted by Marketplace Facilitator Laws?

If you sell products online via platforms like Amazon, eBay, or Walmart, chances are high that these laws apply to you. It’s essential to:

- Understand Your Obligations: Ensure the platform is remitting taxes accurately.

- Stay Informed: Tax laws vary by state and continue to evolve.

- Consult Professionals: If you’re unsure about your tax situation, consult an accountant or tax advisor.

Final Thoughts: Embracing Marketplace Facilitators

Marketplace Facilitators are a game-changer in e-commerce, making it easier for sellers to reach global audiences while staying compliant with tax regulations. While the shift may come with challenges, the benefits of simplified operations and compliance far outweigh the drawbacks.

By leveraging the support of Marketplace Facilitators, you can focus on what you do best building your brand and growing your business. For more insights and tools to simplify your e-commerce journey, visit plugbooks.io.

One thought on “Understanding Marketplace Facilitator: Simplifying Online Sales Tax”