What is 1099-K — If you’re an online seller or run a business that accepts credit cards or online payments, you’ve likely come across this important tax form. Form 1099-K is issued by payment processors to report your total annual income from third-party payment networks like PayPal, Stripe, or Amazon.

Understanding how it works is essential for staying tax-compliant, tracking your earnings accurately, and avoiding unexpected tax surprises.

KeyPoints:

1. What is 1099-K — Reports income from PayPal, Stripe, or Amazon to the IRS.

2. Issued for payments over $600 per year.

3. Reflects your gross income for tax reporting.

4. Allows deducting expenses like fees and shipping.

5. Helps prevent IRS audit risks.

6. Always verify details before filing.

What Is 1099-K?

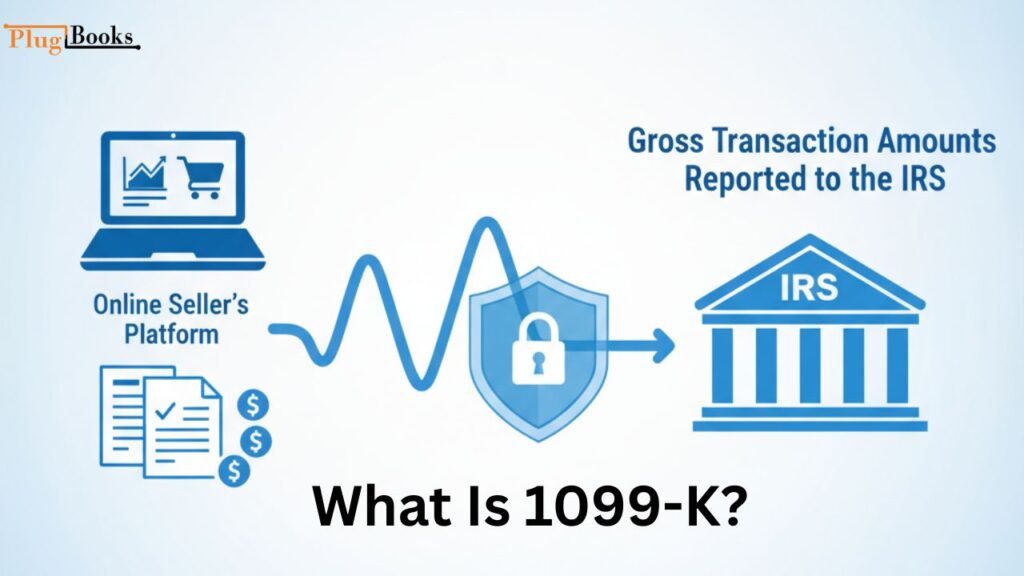

Form 1099-K is a tax document sent out by payment processors to report your total transaction amounts to the IRS. Its main purpose is to make sure businesses accurately report the income they earn through third-party platforms like PayPal, Stripe, or Amazon.

Key Features of Form 1099-K

- Purpose: It tracks the income you receive through credit card payments or third-party payment networks, helping ensure everything lines up with what you report on your taxes.

- Thresholds: Starting in 2023, you’ll get a 1099-K if your payments go over $600 in a calendar year — no matter how many transactions you make.

- Contents: The form shows your gross payments, organized by month and payment method, making it easier to match your earnings with your tax return.

Who Needs to File a 1099-K?

If you’re an e-commerce seller, freelancer, or small business owner who receives payments via platforms like PayPal, Venmo, Stripe, or Amazon, this form applies to you. Even if your transactions are small, reaching the $600 threshold means you’ll receive one.

Note: Receiving a 1099-K doesn’t always mean you owe taxes on the full amount. You can deduct eligible business expenses to lower your taxable income.

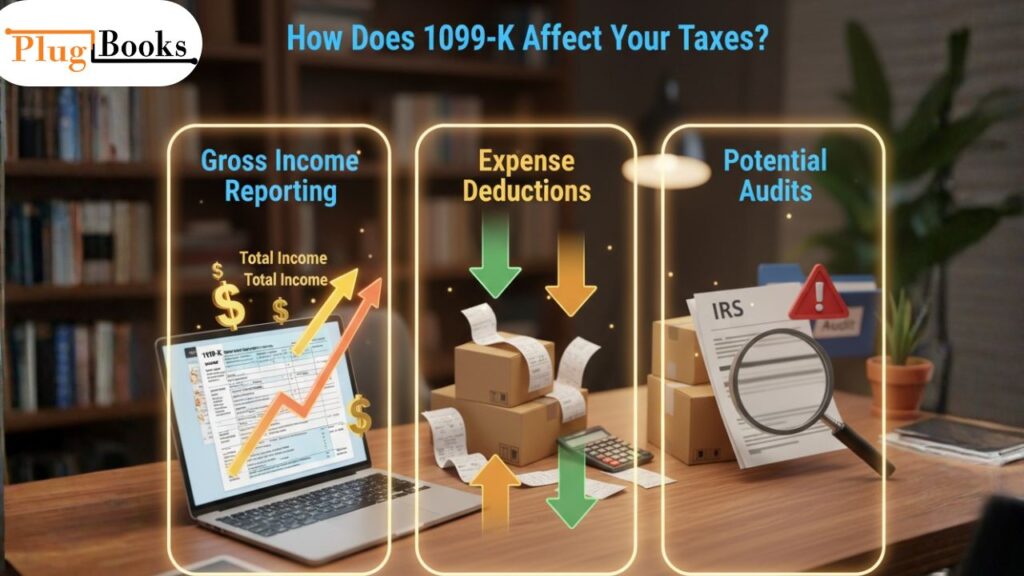

How Does 1099-K Affect Your Taxes?

The IRS uses Form 1099-K to verify that the income you report matches what payment processors report. Understanding how this form impacts your taxes can help you stay compliant and avoid unnecessary issues.

1. Gross Income Reporting

The amount on your 1099-K represents your total gross income before any deductions. This figure includes all payments processed through third-party platforms and must match the income you report on your tax return.

2. Expense Deductions

Tracking your deductible expenses — such as shipping costs, transaction fees, or business supplies — is essential. These deductions help lower your taxable income, reducing the amount you owe.

3. Potential Audits

If there are discrepancies between your reported income and 1099-K filings, the IRS may flag your return for further review. Accurate reporting and proper recordkeeping can help you avoid potential audits.

What is a 1099 K Form?

The U.S. Internal Revenue Service (IRS) uses the 1099-K tax form to report company transactions. People or businesses that get payments through payment cards (like credit or debit cards) or third-party networks (like PayPal, Venmo, etc.) get this type.

A 1099-K form is sent to someone or a corporation that gets $600 or more in payments in a year. The IRS needs this document to know how much money the taxpayer got so they can file their taxes correctly.

What Should You Do If You Receive a 1099-K?

- Review the Form: Verify all information, such as your name, Taxpayer Identification Number (TIN), and income totals.

- Track Your Expenses: Keep detailed records of business-related costs to claim deductions.

- Consult a Tax Professional: For accurate filing and compliance, seek guidance if you’re unsure about how to report the information.

PlugBooks: Your Partner for Hassle-Free Tax Filing

PlugBooks simplifies financial management for Amazon and eBay sellers by providing clear monthly to yearly income and expense reports, making tax filing easier than ever. With accurate and organized reporting, your Form 1099-K data is always accounted for.

If you want to understand how selling costs work, check out our guide on eBay seller fees to stay fully informed. Plus, enjoy 6 months of PlugBooks free, giving you the tools to manage your finances without extra costs.

Where Can You Learn More About 1099-K?

If you want to dig deeper into what is 1099-K, there are a few trusted resources that can help you stay informed and up to date:

- IRS Official Page on Form 1099-K — Get the most accurate and current information directly from the IRS.

- Tax Foundation: Updates on 1099-K Thresholds — Learn about threshold changes, reporting rules, and their impact on sellers.

These resources offer reliable, product-free information, helping you understand your tax obligations with confidence.

Make Tax Time Easier with PlugBooks

What is 1099-K — Managing your taxes and tracking income from multiple payment processors doesn’t have to be stressful. PlugBooks takes the heavy lifting off your plate by automating your e-commerce accounting and connecting seamlessly with platforms like Xero and QuickBooks Online. If you want to understand more about Shopify reporting, check out our guide on Shopify 1099.

With PlugBooks, you can easily reconcile your 1099-K data, track deductions, and stay organized for a smoother tax season. No more juggling spreadsheets or stressing over reports.Learn more about how PlugBooks can simplify your accounting at PlugBooks.io.