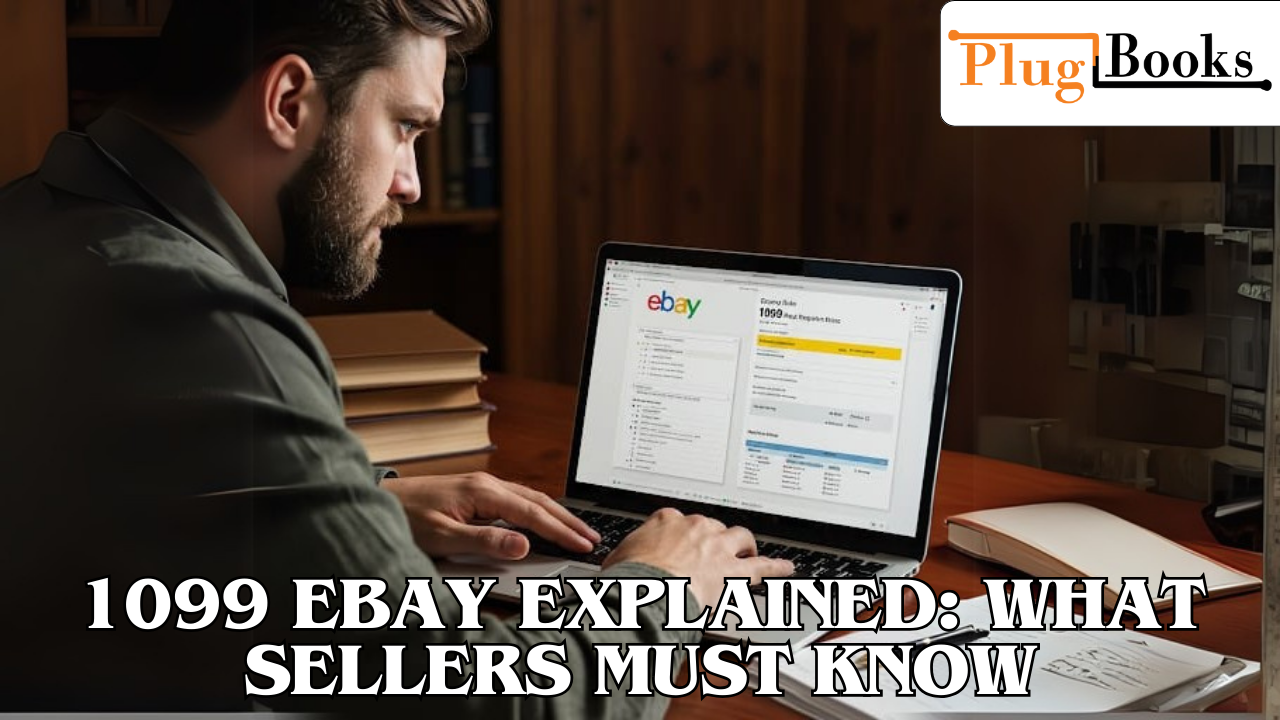

1099 eBay — One of the best ways to earn extra money or even run a small business is by selling on eBay. But once you start selling regularly, you might be surprised to receive a 1099 form from eBay. Understanding this document—especially for tax years like the 2024 1099 form or the 2023 1099 eBay reporting—is essential whether you’re a new seller or a seasoned one.

Let’s break down what this form means, why it matters, and how it impacts your taxes so you can stay organized and compliant.

Keynotes

- $600 Rule: eBay sends a 1099-K if sales hit $600+ (applies to 2023 and 2024).

- Gross Sales: The form reports total sales, not profit.

- IRS Gets a Copy: If you get one, so does the IRS—report it.

- Hobby Sellers Included: Even casual sellers must comply.

- Use PlugBooks: Simplify 1099 tracking with PlugBooks.io.

The 1099 eBay form is what?

Specifically the 1099-K, this form is sent to merchants to record payments made via PayPal or eBay controlled payments. It helps the IRS as well as you monitor your profits from online sales.

Starting with 1099 eBay 2023, a significant change occurred: you were obliged to get a 1099-K if your gross sales exceeded $600 even with only one transaction. That rule still holds going forward into 1099 from 2024.

Should the 1099 eBay 2024 and 2023 rules cause you concern?

Sure. The IRS reduced the reporting threshold in 2023, hence if you made $600 or more you will probably get a 2023 form. This rule still applies in 2024, hence every year you should be ready for it.

These forms still apply even if you are a casual seller—that is, someone who markets used goods from around the house—should your overall sales exceed the level. This implies that marketers of hobbies as well as businesses should keep current.

Typical Issues Regarding eBay seller 1099 Forms

1. Are Taxes Due Just Because I Received a 1099?

Not particularly. Receiving a 1099 eBay form does not always guarantee you will have tax due. You pay taxes on your net profit, which is your income less business expenses including supplies, eBay fees, shipping, and inventory.

2. What Should I Sell Personal Items for?

Although selling used personal items for less than you usually are is not taxed, if your gross sales exceed $600 you could receive a 2024 form. To show you sold at a loss, preserve receipts or a record of your original purchase costs.

3. Can I reject the form?

No—do not overlook the forms 2023 or 2024 forms. Copies also arrive for the IRS. Not reporting it could result in audits or fines.

How Should You Handle a 1099 eBay Form?

Should you have a 2023 form from earlier this year or anticipate a 1099 in 2024 form next year, here is what you should do:

- Check Your Sales Record: Verify the reported figures twice. The 1099-K indicates total sales, hence it won’t deduct fees or shipping charges.

- Keep track of every sale, including related expenses and products sold costs.

- File Clearly: Tell your tax return your income. The IRS did also if you got a 1099.

- See a tax specialist to assist clarify matters, particularly if you’re not sure whether to classify as a hobbyist or business owner.

Benefits of Using PlugBooks for 1099 eBay & Amazon Tracking

PlugBooks is a powerful bookkeeping software designed to make managing your eBay and Amazon finances effortless. Here’s how it helps with 2024 and Amazon 1099 compliance:

- Automated Data Sync: Connect your eBay and Amazon accounts and automatically import all transactions without manual entry.

- Accurate Bookkeeping: Track sales, refunds, fees, and expenses with complete accuracy.

- Tax-Time Ready Reports: Generate clean financial reports that match your 1099-K forms and simplify tax filing.

- Built for Sellers: Works seamlessly with QuickBooks and Xero, helping you manage your entire bookkeeping workflow in one place.

With PlugBooks bookkeeping software, there’s no more scrambling during tax season—everything stays organized, synced, and ready when you need it.

Final Thoughts

If you sell on eBay, this is something you cannot overlook—especially since the IRS reporting standards changed with 1099 eBay 2023 and stay in place for 2024. Even sporadic sellers have obligations to be aware of.

To be ahead of tax season, keep correct records, know your income, and use plugbooks. That will help you to be ready to easily manage your 1099 when it shows up in the mail.

Disclaimer: This blog post provides general information and is not tax advice. Consult a tax professional for personalized guidance. PlugBooks is not responsible for any errors or omissions.

FAQs

1. When will I receive my 1099 eBay form?

You should receive your form by January 31st of the following year. It will include all sales made through eBay’s managed payments or PayPal.

2. Do I need to report my eBay income if I don’t receive a 1099?

Yes, you are still required to report your income if you exceed the $600 threshold, even if you don’t receive a 1099 form.

3. What if I have multiple eBay accounts?

If you have multiple eBay accounts, each one is tracked separately. You’ll receive this form for each account that meets the $600 sales threshold.

4. How do I handle returns or refunds in my form?

Returns or refunds are factored into your gross sales, so make sure to adjust for any refunds when calculating your net income.

5. Can I deduct my business expenses before receiving my form?

Yes, you can deduct eligible business expenses throughout the year to calculate your net profit, even before receiving your 1099 form.

2 thoughts on “1099 eBay Tips: Avoid Common Seller Errors with PlugBooks”