Big Billing has become a critical challenge for growing eCommerce businesses in 2026. Managing hundreds or thousands of transactions across multiple platforms can quickly overwhelm traditional invoicing systems. Sellers often struggle with keeping records accurate, tracking payouts, handling refunds, and ensuring compliance with taxes and fees.

Modern high-volume invoicing solutions help sellers streamline these processes, centralize financial data, and gain clear visibility into revenue. By adopting scalable billing platforms, online sellers can reduce errors, save time, and focus on growth instead of manual bookkeeping.

Whether you sell on Amazon, Shopify, eBay, or multiple marketplaces, understanding how to manage large-scale invoicing effectively is essential for smooth operations and sustainable expansion in 2026.

🔑 Key Takeaways

- Big billing supports high-volume eCommerce operations

- Manual billing increases errors and compliance risks

- Automation improves accuracy and cash flow visibility

- Multi-channel sellers benefit the most

- Scalable billing systems prepare sellers for long-term growth

What Is Big Billing in eCommerce?

High-volume invoicing refers to advanced financial management systems built to handle large-scale eCommerce operations. Unlike basic billing or standard invoicing tools, these scalable billing platforms are designed for sellers who process hundreds or thousands of transactions across multiple marketplaces.

These systems manage:

- High order volumes

- Automated invoicing

- Multi-currency payments

- Tax calculations

- Refunds and adjustments

In 2026, billing is no longer a luxury—it is a requirement for growing eCommerce sellers.

Why Transactions Matters for eCommerce Sellers in 2026

ECommerce platforms are evolving rapidly. Sellers now deal with:

- Frequent payouts

- Complex fee structures

- Cross-border taxes

- Increased audit requirements

Without a scalable billing system, financial data becomes fragmented and error-prone. Billing solutions help sellers stay organized, compliant, and in control of their revenue as their businesses grow.

Frequent High-Volume Invoicing Issues for eCommerce Sellers

High Transaction Volume

As order volume increases, manual billing processes break down and mistakes become more common.

Multi-Channel Sales Complexity

Selling on multiple platforms creates separate reports, payout schedules, and fee structures.

Tax and Compliance Issues

Different regions apply different tax rules, increasing the risk of non-compliance.

Refunds and Chargebacks

Incorrect handling of refunds can cause reconciliation issues and reporting mismatches.

How Big Billing Solutions Work for Online Sellers

Invoicing systems automate the entire billing lifecycle. Once connected to sales platforms, they:

- Capture transactions automatically

- Generate accurate invoices

- Apply correct tax rules

- Track refunds and adjustments

- Create real-time financial reports

This automation reduces human error and gives sellers a clear financial overview.

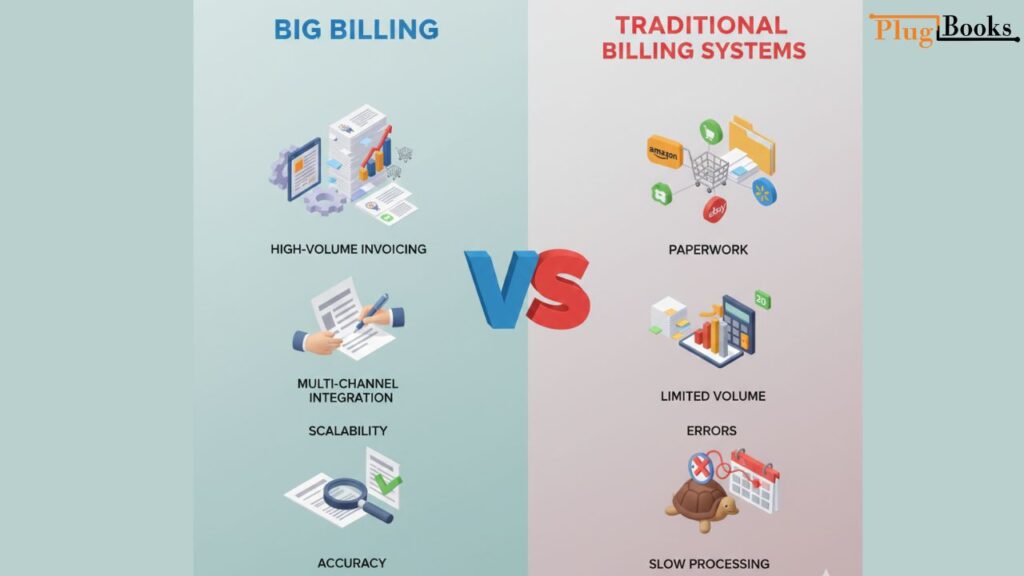

Big Billing vs Traditional Billing Systems

| Feature | Traditional Billing | Big Billing |

| Order Capacity | Low volume | High volume |

| Automation | Limited | Advanced |

| Tax Handling | Manual | Automated |

| Scalability | Poor | Excellent |

| Accuracy | Inconsistent | High |

Billing systems are built for scale, while traditional billing tools are not.

How Big Billing Helps Multi-Channel eCommerce Sellers

For sellers operating across platforms such as Amazon, Shopify, WooCommerce, eBay, Walmart, and Etsy, billing complexity increases rapidly.

With Invoicing solutions:

- All transactions from Amazon, Shopify, WooCommerce, eBay, Walmart, and Etsy are centralized

- Revenue tracking becomes easier across every sales channel

- Reconciliation is simplified, even with different payout schedules and marketplace fees

This centralized visibility helps multi-channel eCommerce sellers scale confidently in 2026 without financial confusion or reporting errors.

Managing Large-Scale Billing, Taxes, and Compliance in 2026

Tax regulations are becoming stricter worldwide. Billing systems help sellers by:

- Automatically calculating applicable taxes

- Maintaining clean invoice records

- Generating audit-ready financial reports

This reduces compliance risks and prepares sellers for tax reviews or audits.

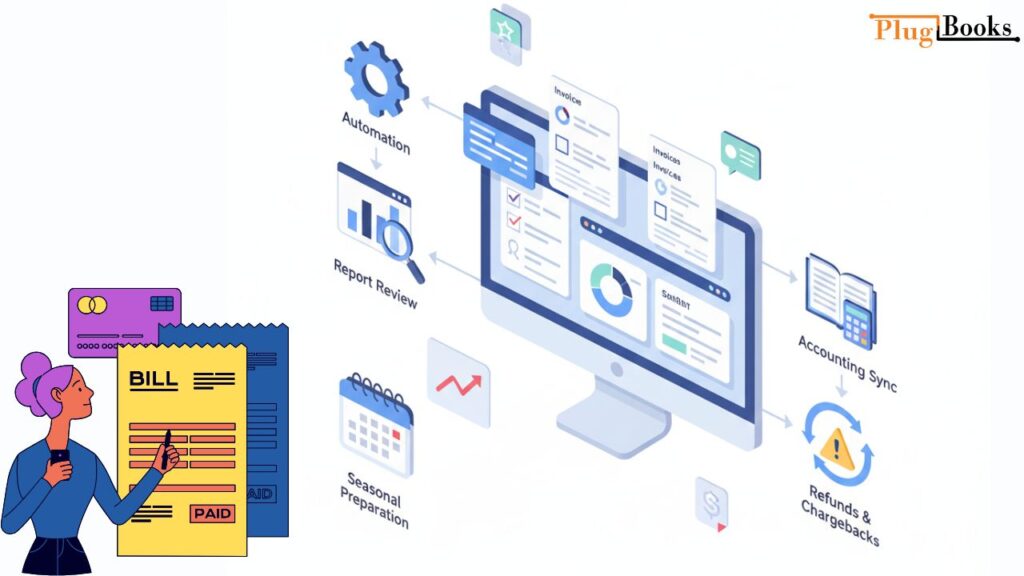

Best Practices for Managing Big Billing Efficiently

- Automate billing wherever possible

- Review billing and payout reports regularly

- Sync billing data with accounting systems

- Track refunds and chargebacks separately

- Prepare billing systems for seasonal sales spikes

Following these practices ensures billing remains accurate as sales grow.

People Also Ask (PAA)

1. What is high-volume invoicing in eCommerce?

High-volume invoicing is a scalable financial system designed to manage large numbers of online transactions efficiently.

2. Do small eCommerce sellers need scalable billing platforms?

As order volumes grow, automated transaction management becomes essential to prevent errors and delays.

3. How does automated invoicing help with taxes in 2026?

It streamlines tax calculations and keeps financial records compliant with regulations.

4. Is advanced billing useful for Amazon and Shopify sellers?

Yes, especially for sellers managing sales across multiple marketplaces.

5. Can automated financial systems reduce billing mistakes?

Automation significantly minimizes manual errors and reconciliation issues.

6. How do sellers choose the right scalable invoicing solution?

By considering transaction volume, platform integrations, and reporting capabilities.

How PlugBooks Brings Clarity to High-Volume eCommerce Transactions

PlugBooks helps eCommerce sellers organize complex, high-volume sales data with precision.

It consolidates transactions from multiple selling platforms into clean, accurate records.

Sellers gain clear visibility into revenue, marketplace fees, and payouts without manual effort.

PlugBooks supports confident scaling by keeping financial operations structured and audit-ready in 2026.

Quick Recap

- Big billing supports high-volume eCommerce sellers

- Automation reduces errors and saves time

- Multi-channel revenue becomes easier to manage

- Tax compliance improves

- Sellers can scale with confidence in 2026

Conclusion

In 2026, eCommerce success depends on systems that grow with your business. High-volume invoicing platforms empower sellers to manage complexity, stay compliant, and focus on growth instead of financial chaos.

By adopting the right scalable billing system, sellers can build organized, efficient, and future-ready eCommerce operations.