Should you have ever purchased something on Amazon, you might have observed that your orders often lack sales tax addition. you might wonder: Does Amazon charge sales tax on all purchases? If so, how much is sales tax on Amazon? Taxes are continuously changing, however it might be difficult to grasp them given Amazon offers so many goods.

This blog article will discuss whether Amazon levies sales tax, its rates, and the elements influencing these taxes. Understanding sales tax can help you to ensure that your Amazon shopping experience goes without any problems.

Keynotes

- Though the amount varies depending on where you live, Amazon does charge sales tax most of the time.

- Sales tax is payable depending on your shipping address rather than your billing address.

- Based on state and municipal rates, Amazon’s sales tax could range from 0% to 10%.

- Third-party Amazon sellers typically have to pay sales tax as well in most states.

- Applying for the Tax Exemption Program will provide businesses or resellers sales tax exemption.

Does Amazon Charge Sales Tax on All Purchases?

Where you live, the items you buy, and whether you are an individual or a business will all affect the sales tax you pay on many Amazon purchases. Thanks to changes in U.S. sales tax laws, Amazon today charges tax on more products than ever before.

Why Does Amazon Charge Sales Tax?

Sales tax laws in the US dictate that online retailers such as Amazon have to pay sales tax on purchases made in states mandated to demand it. States can levy sales tax from online retailers like Amazon even if the business does not have a physical presence in the state since the Supreme Court decided in Wayfair v. South Dakota in 2018.

Amazon thus imposes sales tax depending on the residence of the buyer. Every state has guidelines about the taxes paid and the taxable items. Aside from that, the kind of thing you purchase could affect sales tax. Plugbooks.io, a helpful tool for Amazon sellers, ensures that the taxes you need to collect are tracked and recorded accurately, which is essential for those who sell on Amazon.

How Much is Amazon Sales Tax?

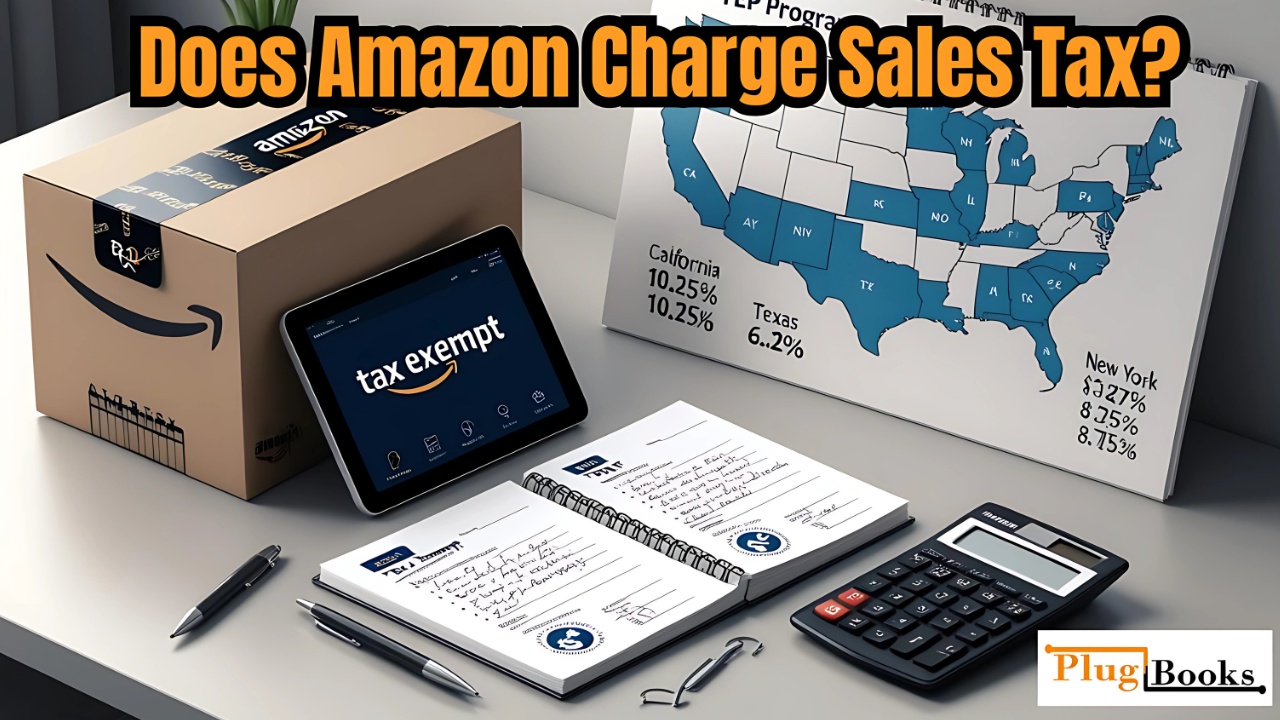

So, how much is sales tax on Amazon? From one state to the next as well as from one county or city to the next inside the same state, the sales tax rate might vary greatly. States under charge between 4% and 10% sales tax; some charge as much as 10%.

For example:

- Consider California for illustration. Certain cities allow the sales tax rate to reach 10.25%.

- In New York, it stands at roughly 8.875%.

- Though it varies in various areas, Texas typically boasts a rate of 6.25%.

Amazon deduces and adds the appropriate sales tax rate to your order based on your shipping address.

How Does Amazon Determine Sales Tax?

When Amazon calculates how much is sales tax on Amazon, it uses the shipping address you provide during checkout. This implies that your order will most likely include a sales tax if you live in a state that levies one. Nevertheless, there won’t be any tax if your state lacks sales tax.

Here’s a summary of how it works:

- Sales Tax Nexus: Laws must mandate Amazon’s charge of sales tax in your state. We term this a “nexus.” Usually, this link is established if Amazon operates warehouses, employees, or stores in your state.

- Product Type: Sales tax may not apply in some areas for items like groceries and clothing.

- Shipping Location: Should you ship to a state requiring Amazon to gather sales tax, tax will be included.

Does Amazon Charge Sales Tax for Third-Party Sellers?

Indeed, Amazon also levies sales tax on orders from other vendors nowadays. Originally some third-party vendors chose not to pay sales tax, but since the laws have changed Amazon now mandates these sellers follow state tax guidelines.

Amazon gathers and distributes sales tax on behalf of third-party sellers in places where it is required, so you won’t have to bother about hand computing and paying taxes. With Plugbooks, Amazon sellers can streamline their tax reporting and ensure they’re compliant with sales tax requirements, helping to maintain an organized accounting system.

Can You Get an Exemption From Sales Tax on Amazon?

Under some circumstances, some purchasers could be able to obtain sales tax relief. Businesses or those who market products to others, for example, can request a sales tax exemption certificate in states where they are allowed to do so. As long as they intend to sell them again, this permits the business to purchase items without paying sales tax.

If you believe you qualify for such an exemption, you will need to apply for and send in the appropriate documentation through Amazon’s Tax Exemptive Program (TEP).

How Plugbooks Helps with Sales Tax Management on Amazon

For Amazon sellers, managing sales tax can be complicated, especially with varying rates across different states and localities. Plugbooks streamlines this process by automatically tracking sales tax obligations for each sale based on the shipping address. It ensures accurate tax calculations, integrates seamlessly with QuickBooks for efficient financial reporting, and simplifies the preparation of tax-related documentation.

By using Plugbooks, Amazon sellers can focus more on growing their business while staying compliant with tax laws without the hassle of manual tax tracking. Helium 10 is a powerful tool suite for Amazon sellers, offering features to help with product research, keyword optimization, and business analytics.

Final Thoughts

Does Amazon charge sales tax?Generally speaking, yes, Amazon does levy sales tax on purchases. This is particularly true in areas governed by legislation mandating it. The precise sales tax you have to pay on Amazon will depend on your shipping region and the tax policies for the item you are purchasing. These taxes should be known to sellers as well as purchasers so that they are paid accurately and there are no shocks at the register.

Whether you are purchasing something or selling something on Amazon, knowing how Amazon manages sales tax will help you to make smarter judgments, adjust your pricing, and prepare ahead.

Disclaimer

This post is aimed to provide you just facts. regarding does Amazon charge sales tax and how much is Amazon sales tax, tax laws and policies are subject to change.Still, rules and legislation pertaining to taxes are always changing. Always consult a tax professional or review your local tax laws for further information regarding sales tax in your area.

FAQs

1. Does Amazon charge sales tax on all items?

Based on state tax laws and shipping location, Amazon charges sales tax on items. Like food or clothing, some goods might not be impacted.

2. Amazon’s sales tax rate is what?

The tax rate in your state and your residence determine the sales tax you pay on Amazon. Rates lie between 0% and 10%.

3. Why does Amazon charge sales tax?

Sales tax nexus rules force Amazon to collect sales tax in states where it has a nexus, therefore establishing physical presence.

4. Does Amazon’s sales tax apply to me?

If you are a reseller, there is a programme on Amazon called TEP which helps with sales tax relief.

5. How can I find out whether my order is being added with sales tax by Amazon?

Your total when you check out will include the sales tax based on your residence.

One thought on “Does Amazon Charge Sales Tax? State-by-State Breakdown”